Your pharmacy marketing should pay for itself!

If you’re bleeding money in your marketing department, it’s time to revisit and realign your strategy. Don’t let your pharmacy marketing be a drain on your cash flow.

You can stop worrying about marketing budgets being expensive. Instead, turn leads into customers and make money continuously. It starts with a few new concepts and a new way of looking at marketing from a financial and a cash flow perspective.

New Pharmacy Marketing Terminology

To look at your pharmacy marketing differently, we need to make sure you understand the important terminology and KPIs (key performance indicators).

Leads

A lead is a marketing term for an individual who can become a paying customer. First, a person is a lead, then becomes a customer, and for most pharmacies, a sale means filling prescriptions. We’ll address the ideal sale later.

Margin Per Sale

A sale can also be considered a transaction in your pharmacy. If a customer comes in and buys a bottle of vitamins for $30, the bottle costs you $12, then your margin for that sale is $18. To calculate this marketing KPI, you can take your total sales dollars and divide it by the number of transactions. You should calculate this for your Rx and OTC separately.

Margin Per Lead

You can calculate your average margin per lead once you have generated sales from your marketing efforts. Now, technically, leads don’t produce sales or margin. The definition of a lead is someone who is not yet a customer. However, this is critical to calculate as it gives you essential averages and trends. To calculate, take your total margin for a time period and divide it by the total number of new leads for the same period.

Cost of Acquisition

How much does it cost you to acquire a new paying customer? Most pharmacies only look at this number for their prescription business. Total up your marketing spend and then divide it by the number of new patients. However, this number becomes much more powerful when thinking beyond prescriptions and into OTCs as you have much more control over selling OTCs than you do Rxs.

Average Cart Value

The average cart value refers to the average amount spent by a single customer per transaction. You will want to look at this number for all revenues except prescriptions for pharmacies. Essentially, you want to know the average amount a patient spends with you every time they come into your pharmacy for non-prescription items. Some patients will spend $0, while others spend $10, and still, others will spend $50. Knowing what the average transaction brings in will help you make better decisions for your pharmacy.

Lifetime Customer Value or Lifetime Margin Value

The total profit a customer brings to your pharmacy over their lifetime as a customer. There are two ways to influence this number. One, keep customers as patients longer. Two, increase their average cart value. Most owners don’t know how long their average customer stays. I often use a conservative one year for patient retention. In a low-margin pharmacy business, focus on the margin value. Always ask yourself what else can you sell them and how you can get your patients to buy more.

Return On Ad Spend (ROAS)

When calculating this number, you always want it to be greater than 1. That means you made more money than you spent. When selling a service that is essentially 100% margin, you can use revenue numbers. When you sell a product, you will want to use margin, not revenue, to calculate this metric. To figure ROAS take the total revenue/margin and divide it by the cost of the marketing campaign. If you ever use a marketer or agency, they should calculate this number for you.

Front-End Offer

A front-end offer is an initial offer shown to a potential customer through advertising. Increase your effectiveness with specificity, and give it a sexy name! Don’t dangle cheap free offers; put out the $150-$300 offerings! Bundles also work great because individual items can’t be price-shopped.

Back-End Offer

A back-end offer is an add-on item(s) that complements the front-end offer, which should help solve the next problem for the customer. It can be an upsell (more expensive) or downsell (less expensive), but all items should continue to solve the customers’ problem.

Phew! That is a lot of new terminologies. I bet that most of these terms are brand new to you. It may take a while for them to become second nature. The best way to master them is to start using them in your pharmacy. Let’s now dive into how to do that.

Where Most Pharmacy Owners Go Wrong In Pharmacy Marketing

Because dispensing is your primary source of revenue, most pharmacies will focus on getting more prescriptions customers in their marketing. That is a noble goal. However, because Rx revenue is extremely low margin, and it can take weeks (or months) to receive that revenue, this is a surefire method for killing your pharmacy marketing budget.

Let me explain:

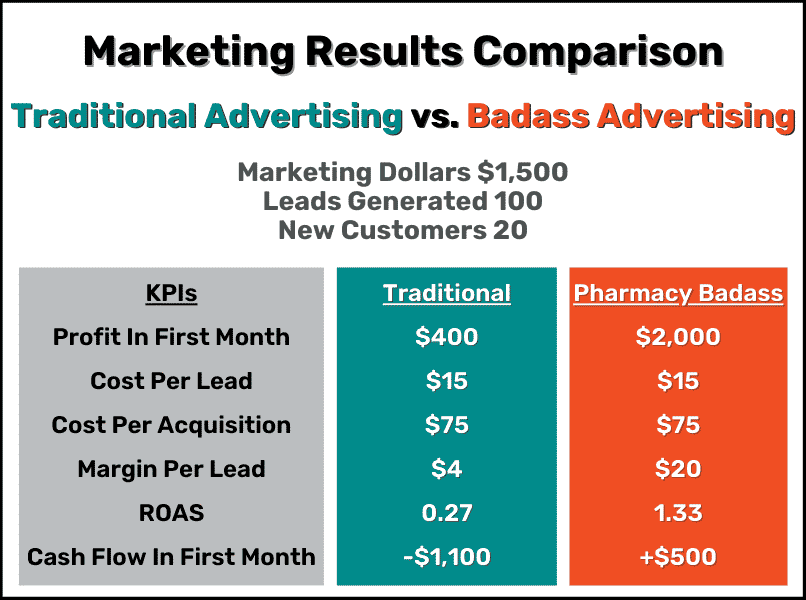

- You spend $1,500 on a Facebook marketing campaign.

- 100 new leads are generated.

- 20 become new paying customers, getting 2 Rxs each.

- Assuming $10 margin per Rx filled, you gained $400 profit.

Sounds like a successful marketing campaign, right?

Here’s your KPIs

- $15 cost per lead

- $75 cost per acquisition

- $4 margin per lead

- ROAS 0.27 (bad as it’s less than 1)

- Cash flow is negative $1,100 (-$1,500 + $400)

Ok, it doesn’t look so good now. This marketing goal is what most pharmacies do and why marketing is constantly sucking up cash flow dollars. You focus on low-margin, poor cash flow prescriptions instead of concentrating on high-profit, over-the-counter products or services.

In the example above, the marketing campaign was successful. Twenty new paying customers and $400 in profit are positive metrics. Once you add in the lifetime value of those new patients, $4,800, then it really looks good. You paid $1,500 to acquire 20 new patients that will bring in $4,800 of profit in a year.

BUT, you lost money from a cash flow perspective. The first month you are negative $1,100 in cash. You won’t break even until the end of the 4th month. This negative cash flow is why owners always say marketing is expensive. It isn’t because they can’t afford the $1,500 to pay for the Facebook campaign. It is simply because it takes so long to see that cash return to the bank account.

What if you could do this differently?

If there was a way to be cash flow positive from that very first sale? What if you were always making money on your marketing? How much would you spend on marketing? Let’s explore how pharmacy owners should be marketing.

Think Outside Of Dispensing

To have positive cash flow in your pharmacy marketing (and create an unlimited marketing budget), you need your margin per lead to be higher than your cost per lead. In the above example, it was the opposite: $4 margin versus $15 cost per lead. That can be extremely tough if you rely on prescriptions. However, it becomes much easier when using high-margin OTCs and cash-based services in your marketing.

Learn how to market your products and services outside of dispensing for much bigger margins. Let’s go through an example below:

- You spend $1,500 on a Facebook marketing campaign.

- 100 new leads are generated.

- 20 become new paying customers, purchasing $200 worth of goods or services each.

- Assuming a 50% margin, you earn $2,000 profit.

Looks much better than our first try, right?

Here’s your KPIs

- $15 cost per lead

- $75 cost per acquisition

- $20 margin per lead

- ROAS 1.33 (great as it’s more than 1)

- Cash flow is positive $500 (-$1,500 + $2,000)

In this example, I hope you can see how we can now have an unlimited marketing budget. You only need to come up with the initial cost of the campaign once, as you can reinvest the profits from your newly acquired customers back into your marketing. You are cash flow positive, so you never run out of money to fund your marketing. When you make a profit, even a small one, that pays for your marketing with the first customer purchase, this is the key to unlocking an unlimited marketing budget.

The total return on investment for this campaign just gets better over time. More than likely, your new patients will love what you sold them and keep coming back for more. If we assume they come back three more times, you earned $8,000 in profit from a $1,500 marketing spend.

Promote High Margin Offers

When you plan your pharmacy marketing, you now see how critical it is to focus on high-margin offers instead of just gaining a new Rx patient. I consider a high-margin offer in the pharmacy to be $100 or more profit in a single transaction. You might be thinking, what can I sell in my pharmacy that has that much profit?

I am so glad you asked! While I will cover a few ideas here, there is no limit to what you can do. You can bundle together services and products to create a unique offer that only you have. The more unique, the more you can charge, and patients will be happier.

You might need to bundle some of these together to hit your target profit number. “The Ultimate Weight Loss Supplement Bundle” sounds pretty sexy, right?

Example of OTC products with higher margins:

- CBD Products (tincture, gels, cream, vaginal, sleep, pain)

- CofixRx and Hollywog from GM Pharmaceuticals and 4 weeks of Zoom Group weight loss calls.

- Food sensitivity test from Cell Science Systems

- Package of 6 – Detox foot baths

- Extreme Allergy Relief Bundle (Navage, cromolyn spray, humidifier, bed bug treatment, allergy drops, and extra bonus points for getting Clemastine Rx!)

- Approved Medical Solutions – Nitric Oxide

- Pharmanex Antioxidant Life-Pak Nano

These are just some samples. The sky is the limit. Being creative and unique is the key to success. Marketing for these niche items will make your marketing more effective and drive the type of patients you want into your pharmacy.

Keys To Unlock Your Unlimited Marketing

- Margin per sale is larger than cost per sale. Make money from the customer the first time they pull out their wallet.

- You’re always making money on your front-end offer.

- Massive profit potential comes from adding back-end offers, such as one on one consulting, repeat visits, adding prescriptions.

- It’s easier to make someone open their wallet again if they’ve opened it to you before.

To learn about other strategies to help improve the profitability of your pharmacy, be sure to join DiversifyRx’s private Facebook Group or email us at in**@*********rx.com.